Loading

Get Ez740 Ic

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ez740 Ic online

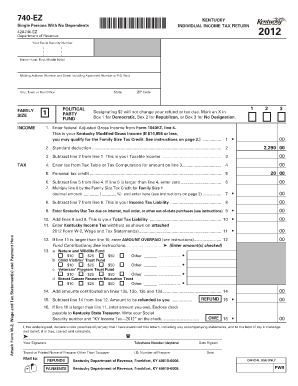

Filling out the Ez740 Ic, Kentucky's individual income tax return, can be straightforward with the right guidance. This comprehensive guide will help you navigate each section of the form to ensure accurate completion.

Follow the steps to successfully complete the Ez740 Ic online.

- Click ‘Get Form’ button to access the Ez740 Ic online form and open it in your preferred editor.

- Enter your social security number in the designated field, ensuring accuracy for identification purposes.

- Provide your full name in the order of last name, first name, and middle initial as applicable.

- Fill in your mailing address, including any apartment number or P.O. Box, city, state, and ZIP code.

- Indicate your family size by entering '1' since this form is for single persons with no dependents.

- Report your federal adjusted gross income from Form 1040EZ, specifying the amount on Line 1.

- The standard deduction of $2,290 is preprinted; confirm that it appears correctly on Line 2.

- Calculate your taxable income by subtracting Line 2 from Line 1 and enter the result on Line 3.

- Determine the tax owed from the tax table or tax computation and enter it on Line 4.

- If applicable, enter your personal tax credit on Line 5. Subtract this amount from Line 4 and place the result on Line 6.

- If eligible, compute and enter the family size tax credit on Line 7 based on your income.

- Calculate your income tax liability on Line 8 by subtracting Line 7 from Line 6.

- Combine any additional tax amounts (if any) on Line 9 and add them to Line 8 to get your total tax liability on Line 10.

- Enter the Kentucky income tax withheld as noted in your W-2 statements on Line 11.

- If the withholding amount exceeds your total tax liability, calculate your overpayment and report it on Line 12.

- For voluntary contributions, complete Lines 13a through 13d with the amounts you wish to donate.

- Subtract Line 14 from Line 12 to reflect the refund amount on Line 15 or determine your tax owed on Line 16.

- Review your completed form for any errors before signing and dating it, ensuring all attachments are included.

- Once you are satisfied with your filled-out form, save changes, download, or print a copy as needed.

Begin filling out your Ez740 Ic online today for a smooth tax filing experience.

A contract amendment allows the parties to make a mutually agreed-upon change to an existing contract. An amendment can add to an existing contract, delete from it, or change parts of it. The original contract remains in place, only with some terms altered by way of the amendment.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.