Loading

Get Cp080

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Cp080 online

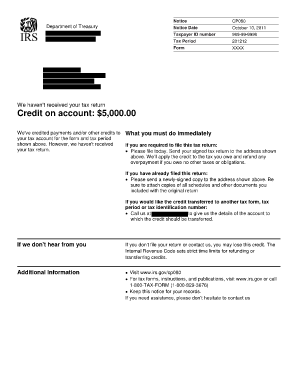

The Cp080 notice serves as a reminder for taxpayers who have not submitted their tax returns. This guide provides a comprehensive, step-by-step approach to filling out the Cp080 online, ensuring clarity and efficiency for all users.

Follow the steps to complete the Cp080 form online

- Press the ‘Get Form’ button to access the Cp080 notice and open it in your preferred online editor.

- Review the notice date and ensure that your taxpayer ID number is correctly reflected.

- Examine the tax period specified on the form to confirm it matches your records.

- If you have not yet submitted your tax return, prepare it and ensure it is signed. Include any applicable schedules or additional documents.

- If you have already filed the return, locate a newly-signed copy and attach all necessary schedules and documents before proceeding.

- Double-check all information for accuracy, including your personal details and any relevant tax credits.

- Once you have completed the form, save any changes you've made. You may choose to download, print, or share the Cp080 notice as needed.

Complete your forms online today to ensure timely processing.

There are many reasons why the IRS may send a letter or notice. It typically is about a specific issue on your federal tax return or tax account. ... You may get a notice that states the IRS has made a change or correction to your tax return. If you do, review the information and compare it with your original return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.