Loading

Get Nevada Modified Business Tax Return 2013 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Nevada Modified Business Tax Return 2013 Form online

Filling out the Nevada Modified Business Tax Return 2013 Form online can streamline your tax reporting process. This guide will provide user-friendly instructions to ensure accurate completion of the form, helping you navigate each section with confidence.

Follow the steps to successfully complete the form online.

- Click ‘Get Form’ button to obtain the form and open it in your preferred document editor.

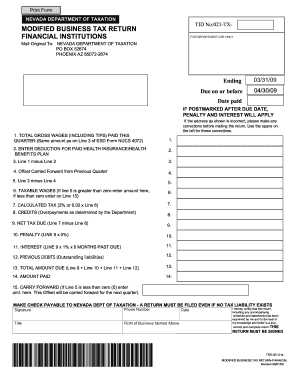

- Begin with Line 1, where you will enter the total gross wages and reported tips paid during the quarter. Ensure this amount aligns with Line 3 of the ESD Form NUCS 4072.

- Proceed to Line 2 and enter the deduction for employer-paid health insurance or health benefits plan costs incurred during this quarter.

- Calculate Line 3 by subtracting Line 2 from Line 1. This gives you the total wages subject to tax.

- If applicable, on Line 4, enter any offsets carried forward from the previous quarter, where allowable health care costs exceeded gross wages.

- Calculate Line 5 by subtracting Line 4 from Line 3. This reflects your taxable wages.

- For Line 6, if Line 5 is greater than zero, enter this amount here. If less than zero, this will be entered on Line 15 as the carry forward.

- On Line 7, calculate the tax by multiplying Line 6's taxable wages by the tax rate (2%).

- For Line 8, enter any credits for overpayments from prior reporting periods as determined by the Department.

- Compute the net tax due on Line 9 by subtracting Line 8 from Line 7.

- If your return is late, calculate any penalties on Line 10 according to the prescribed rates based on how many days late the payment is.

- Calculate interest on Line 11 by multiplying Line 9 by 1% for each month overdue.

- Input any previous debits established for previous quarters on Line 12.

- Add Lines 9, 10, 11, and 12 on Line 13 to find the total amount due.

- On Line 14, enter the amount you are submitting with your return. If Line 5 was less than zero, use Line 15 for the carry forward amount.

- After thoroughly reviewing your entries, you can save changes, download, print, or share the completed form as necessary.

Start completing your Nevada Modified Business Tax Return 2013 Form online today!

Related links form

Modified Business Tax has two classifications: General Business – The tax rate for most General Business employers, as opposed to Financial Institutions, is 1.378% on wages after deduction of health benefits paid by the employer. However, the first $50,000 of gross wages is not taxable.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.