Loading

Get Iowa Social Security Worksheet

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Iowa Social Security Worksheet online

Completing the Iowa Social Security Worksheet is an essential step in accurately reporting your taxable Social Security benefits. This guide will provide you with clear instructions on how to fill out the form online, ensuring a straightforward and supportive process.

Follow the steps to complete the Iowa Social Security Worksheet online.

- Click ‘Get Form’ button to obtain the Iowa Social Security Worksheet and open it for completion.

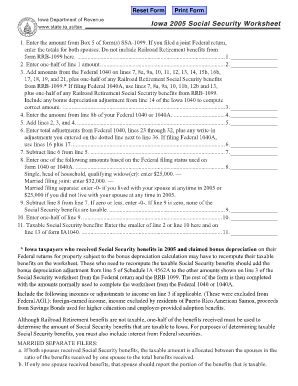

- Begin with line 1 by entering the amount from Box 5 of your form(s) SSA-1099. If applicable, include totals for both partners if you filed a joint Federal return. Do not include Railroad Retirement benefits.

- On line 2, enter one-half of the amount you calculated on line 1.

- Proceed to line 3 and add the amounts from lines 7, 8a, 9a, 10, 11, 12, 13, 14, 15b, 16b, 17, 18, 19, and 21 of your Federal 1040. If you filed a Federal 1040A, use the relevant lines indicated. Also, include one-half of any Railroad Retirement benefits.

- For line 4, enter the amount from line 8b of your Federal 1040 or 1040A.

- Add the amounts from lines 2, 3, and 4 on line 5.

- On line 6, input total adjustments from your Federal 1040, lines 23 through 32, plus any adjustments you wrote on the dotted line next to line 36. If you filed a 1040A, use lines 16 plus 17.

- Subtract line 6 from line 5, and record the result on line 7.

- For line 8, enter an amount based on your Federal filing status: $25,000 for single, head of household, or qualifying widow(er); $32,000 for married filing jointly; or $25,000 or -0- for married filing separately based on your living situation in 2005.

- Subtract line 8 from line 7 for line 9. If this amount is zero or less, enter -0-. If line 9 equals zero, it means none of the Social Security benefits are taxable.

- On line 10, enter one-half of the amount from line 9.

- Finally, for line 11, enter the smaller amount between line 2 or line 10. This value should also be included on line 13 of form IA1040.

Start filling out your Iowa Social Security Worksheet online today for accurate reporting.

Which states tax Social Security benefits? En español | Colorado, Connecticut, Kansas, Minnesota, Missouri, Montana, Nebraska, New Mexico, North Dakota, Rhode Island, Utah, Vermont and West Virginia collect state income tax on Social Security payments to at least some beneficiaries.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.