Loading

Get Ia 126 Fillable Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ia 126 Fillable Form online

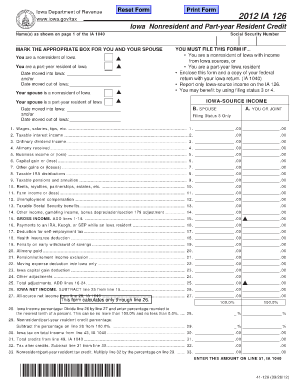

Filling out the Ia 126 Fillable Form online can be a straightforward process if you follow the right steps. This guide is designed to help individuals, including nonresidents and part-year residents of Iowa, complete the form accurately and efficiently.

Follow the steps to complete the Ia 126 Fillable Form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your name(s) as shown on page 1 of your IA 1040 in the designated field.

- Provide your Social Security number in the respective field.

- Select the appropriate box indicating your residency status, whether you are a nonresident of Iowa or a part-year resident of Iowa.

- If applicable, fill in the dates you moved into or out of Iowa.

- If you have a spouse, indicate their residency status and the respective dates they moved into or out of Iowa.

- Proceed to list your Iowa-source income by filling in the fields under the 'Iowa-source income' section. Provide information regarding wages, salaries, taxable interest, and other income sources as instructed.

- After reporting all income, calculate your total gross income by adding all income sources listed.

- Enter any allowable adjustments on lines 16 through 24 if applicable, and calculate the total adjustments.

- Subtract the total adjustments from your gross income to arrive at your Iowa net income.

- Calculate your Iowa income percentage by using line 26 divided by line 27, rounding your answer to the nearest tenth of a percent.

- Compute the nonresident/part-year resident credit percentage by subtracting the percentage from 100.0%.

- Determine your Iowa tax on total income from line 30, and the total credits from line 31.

- Subtract the total credits from the Iowa tax to find your tax after credits.

- Calculate the nonresident/part-year resident tax credit based on the previous figures.

- Once all fields are filled out and reviewed, save your changes, download the form, print it, or share it as needed.

Complete your Ia 126 Fillable Form online today for a hassle-free filing experience.

The nonresident or part-year resident then completes a Schedule IA 126. On the IA 126, only Iowa income is reported and a percentage of Iowa income to total income is determined. The taxpayer receives a credit against the initial tax liability based on the percentage of income from outside Iowa.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.