Loading

Get Mi 1040es

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MI 1040ES online

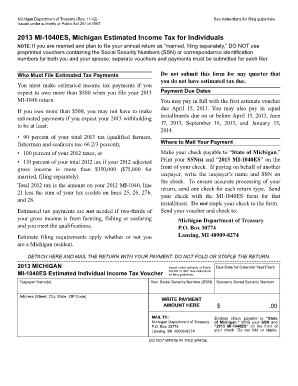

This guide provides clear and supportive instructions for filling out the MI 1040ES, Michigan's Estimated Income Tax Form for Individuals. By following these steps, you can efficiently complete and submit your form online.

Follow the steps to complete your MI 1040ES online.

- Click ‘Get Form’ button to access the MI 1040ES and open it for editing.

- Fill in your personal information, including your name(s), address (street, city, state, ZIP code), and Social Security Number (SSN). Make sure all details are accurate to avoid processing delays.

- If applicable, enter your spouse’s Social Security Number next to yours. Remember that if you are filing as married but separately, to use separate vouchers.

- Indicate the payment amount you are submitting by writing the total in the designated area. Ensure this amount reflects your estimated income tax for the period.

- Review the deadlines for your payments and confirm that you are submitting your form and payment on time. Refer to the due dates mentioned in the form.

- Prepare your check, making it payable to 'State of Michigan.' Write your SSN and '2013 MI-1040ES' on the front of the check. Do not staple it to the form.

- Detach the completed form and mail it with your payment to the Michigan Department of Treasury at the provided address. Follow the instruction not to fold or staple the return.

- Once the form is filled out and sent, you can save any changes made during the process, download a copy for your records, or share it if necessary.

Complete your MI 1040ES online to ensure timely and accurate filing.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

MI-1040ES Estimated Individual Income Tax Voucher Filer's Name(s)

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.