Loading

Get 2011 E 234 Forms

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2011 E 234 Forms online

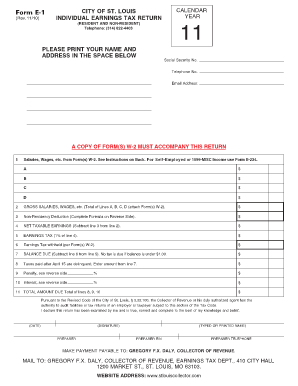

Filling out the 2011 E 234 Forms online is essential for users who are self-employed or have income reported on Form 1099-MISC. This guide provides support and instructions on each section and field of the form to ensure accurate completion.

Follow the steps to fill out the 2011 E 234 Forms online in a simple and efficient manner.

- Click the ‘Get Form’ button to obtain the form and access it in the editor.

- Provide your name, address, and Social Security number in the spaces provided at the top of the form.

- Enter your contact telephone number and email address to ensure communication regarding your submission.

- Input earnings details from your Form W-2 on Line 1, distinguishing between various income sources if applicable.

- Calculate the total gross salaries and wages on Line 2 by adding all amounts entered in Line 1.

- If applicable, complete the Non-Residency Deduction calculation according to the provided formula on the reverse side and enter the result on Line 3.

- Calculate your net taxable earnings by subtracting the non-residency deduction (if any) from the total gross earnings on Line 4.

- Determine the earnings tax owed by multiplying the net taxable earnings by the applicable tax rate and entering that amount on Line 5.

- Enter any earnings tax withheld according to your Form W-2 on Line 6.

- Calculate the balance due on Line 7 by subtracting any taxes withheld from the total tax owed.

- Complete Line 11 to calculate any additional penalties or interest, if applicable.

- Sign and date the form at the bottom, confirming the accuracy of the information provided.

- Once all sections are filled out correctly, save your changes, and then choose to download, print, or share the form as needed.

Start your completion of the 2011 E 234 Forms online today!

Amended Return To file an amended individual income tax return, use Form MO-1040. Check the box at the top of the form. Complete Forms MO-1040 and MO-A, pages 1 and 2, using corrected figures. Attach all schedules along with a copy of your federal changes and your Federal Form 1040X.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.