Loading

Get Fillable Form 3921

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Fillable Form 3921 online

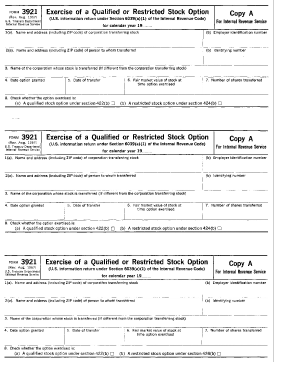

The Fillable Form 3921 is a key document related to stock options that allows users to report the transfer of stock acquired through an employee stock purchase plan. This guide will provide clear instructions on how to complete this form online, ensuring that users can fill it out accurately and efficiently.

Follow the steps to complete the Fillable Form 3921 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your name, address, and Social Security number in the appropriate fields. Ensure that your information is accurate to avoid any processing issues.

- Next, you will need to fill in the details of the stock option you exercised. This includes the date of exercise, the number of shares acquired, and the option price per share. Double-check these figures for correctness.

- In this section, you’ll specify the type of stock option, whether incentive stock options (ISOs) or non-qualified stock options (NSOs). Understanding the type will clarify your tax implications.

- Provide information regarding the employer who granted the stock options. This includes the employer's name, address, and contact information as requested on the form.

- After filling in all the necessary fields, review the form for completeness and accuracy. It is crucial to ensure all information is entered correctly to prevent issues during submission.

- Finally, save your changes. You can download, print, or share the completed Fillable Form 3921 as needed.

Complete your Fillable Form 3921 online today to ensure you meet your reporting requirements.

Review Carta's full Form 3921 workflow and FAQs here....Generating Form 3921 Navigate to Tax > Form 3921. ... Click Generate. Select the Effective Year of the report. ... Complete the requested contact details. ... The form will take a few minutes to generate depending on the number of ISO exercises in that tax year.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.