Loading

Get Illinois 2012 Schedule Nr Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Illinois 2012 Schedule Nr Form online

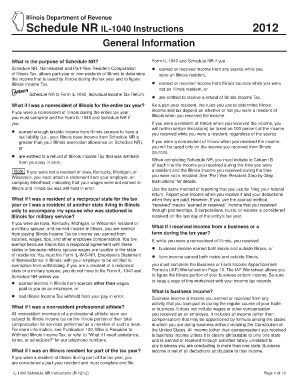

This guide provides comprehensive instructions for completing the Illinois 2012 Schedule Nr Form online, specifically designed for nonresidents and part-year residents. Following these steps will help ensure accurate tax calculations and compliance with Illinois tax regulations.

Follow the steps to complete the Illinois 2012 Schedule Nr Form seamlessly.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by providing your personal information, including your name and address, at the top of the form.

- Indicate your filing status and whether you were a full-year resident of Illinois during the tax year. Check ‘Yes’ or ‘No’ accordingly.

- If applicable, specify whether you were a resident of a reciprocal state or a military spouse, and provide the necessary dates and information regarding your residency.

- Fill in your federal total income in Column A, and determine the Illinois portion of income to include in Column B, following detailed instructions for each line.

- Report all relevant types of income including wages, salaries, and any business profits, along with necessary documentation if specified by the form.

- Complete the adjustments to income section, ensuring to report any allowable deductions associated with your Illinois income.

- Finalize your tax computation by following the instructions on how to calculate your taxable income and any applicable tax credits.

- Review all entries for accuracy, and once complete, you have options to save changes, download, print, or share the form as necessary.

Start filling out the Illinois 2012 Schedule Nr Form online today for a seamless tax filing experience.

received as income in respect of a decedent) from a source in Iowa, Kentucky, Michigan, or Wisconsin, refer to the instructions for Form IL-1040 (Individual Income Tax Return), Schedule CR (Credit for Tax Paid to Other States) for rules concerning compensation in states with reciprocal agreements.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.