Loading

Get 740 Np R 2012 Fillable Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 740 Np R 2012 Fillable Form online

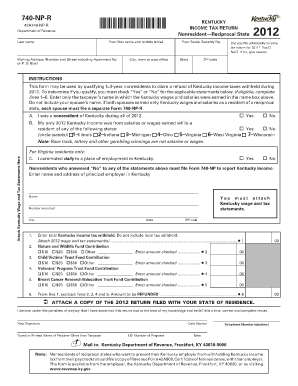

The 740 Np R 2012 Fillable Form is designed for qualifying nonresidents to claim a refund on Kentucky income taxes withheld during the year 2012. This guide will provide you with clear, step-by-step instructions to successfully complete the form online, ensuring all necessary details are accurately entered.

Follow the steps to complete the 740 Np R 2012 Fillable Form online

- Begin by clicking the ‘Get Form’ button to access the 740 Np R 2012 Fillable Form and open it in your preferred online editor. Ensure you are using a compatible web browser for the best experience.

- Fill in your last name, first name, and middle initial in the designated fields at the top of the form.

- Enter your mailing address, including any apartment number or P.O. Box, and ensure to include the city, state, and ZIP code.

- Provide your Social Security number in the specified section to correctly identify your tax record.

- Indicate whether you filed a Kentucky income tax return for 2011 by selecting 'Yes' or 'No.' If you select 'No,' provide a brief explanation in the space provided.

- Check 'Yes' or 'No' for statement A confirming you were a nonresident of Kentucky for all of 2012.

- For statement B, specify if your only Kentucky income in 2012 was from salaries or wages earned as a resident in a reciprocal state. Circle the applicable state(s) from the provided list.

- Complete statement C if you are a Virginia resident, indicating whether you commuted daily to a workplace in Kentucky.

- If you answered 'No' to any of the prior statements, note that you must file a different form, the 740-NP.

- List the name and address of your principal employer in Kentucky, including the street number, city, state, and ZIP code.

- Enter the total amount of Kentucky income tax withheld from your wages as reported on your tax statements.

- Complete the contribution sections (lines 2-5) if you choose to donate to any of the listed funds by marking your contribution amount.

- Calculate the amount to be refunded by subtracting the total contributions from the income tax withheld and write this amount on line 6.

- Attach a copy of your return filed with your state of residence when you are ready to submit.

- Finally, sign the form to declare that your information is true to the best of your knowledge, and provide the date of signing.

Complete your form online today and ensure all your information is accurately submitted.

If you don't make acceptable payment arrangements and/or don't make the payments you agreed to, the Department of Revenue will take action to collect the money you owe. Not paying your taxes can result in the Department of Revenue taking Collection Actions.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.