Loading

Get 100 Es Instructions

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 100 Es Instructions online

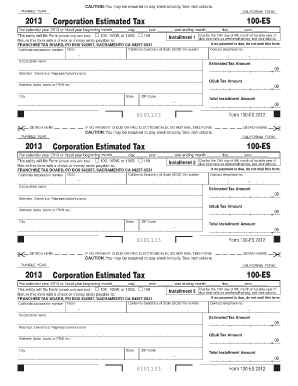

Filling out the 100 Es Instructions for California Corporation Estimated Tax can be straightforward with the right guidance. This guide provides clear, step-by-step instructions to help you navigate each section of the form online.

Follow the steps to successfully complete your 100 Es Instructions online.

- Click ‘Get Form’ button to access the 100 Es Instructions and open the form in the document editor.

- Enter the taxable year for which you are reporting. This should reflect the calendar year you are filing for, such as '2013'.

- Specify whether your entity will file Form 100, 100W, 100S, or 109 by checking the appropriate box. This indicates the type of corporation reporting.

- Fill in the correct installment due dates for your payments. Ensure that these dates are accurate and account for any weekend or holiday adjustments as noted in the instructions.

- Complete the California corporation number, Secretary of State (SOS) file number, and Federal Employer Identification Number (FEIN) as required.

- Provide the corporation name along with the address, including suite, room, or PMB number, city, state, and ZIP code.

- Input the attention of the owner's or representative's name if necessary, as well as the estimated tax amount, if applicable.

- Review all entries for accuracy. Pay attention to the total installment amount and ensure all calculations are correct.

- Once everything is filled out correctly, save your changes. You may choose to download, print, or share this form as needed.

Complete your 100 Es Instructions online today to ensure compliance and timely submission.

Related links form

Electronic payments can be made using Web Pay on the Franchise Tax Board's (FTB's) website, electronic funds withdrawal (EFW) as part of the e-file tax return, or your credit card. For more information or to obtain the waiver form, go to ftb.ca.gov/e-pay.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.