Loading

Get Form 8857 (rev. December 2013) - Internal Revenue Service

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 8857 (Rev. December 2013) - Internal Revenue Service online

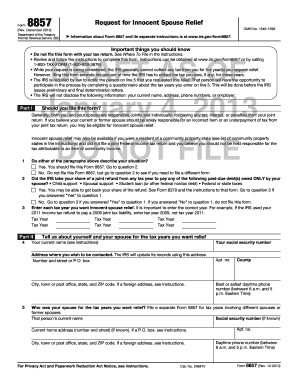

Form 8857 is designed for individuals seeking innocent spouse relief from joint tax liability. This guide provides clear, step-by-step instructions on completing the form online.

Follow the steps to fill out the Form 8857 effectively.

- Press the ‘Get Form’ button to access the form and open it in your preferred editor.

- Read the initial instructions to determine if you should file this form based on your current or former spouse’s tax liabilities.

- In Part I, respond to the questions about your eligibility for innocent spouse relief. Enter the tax years for which you are requesting relief in the designated fields.

- In Part II, provide your personal information including your name, social security number, contact address, and information about your spouse for the relevant tax years.

- Continue in Part II by detailing your marital status and relevant circumstances regarding education, abuse, or any mental/physical health problems during the tax years in question.

- In Part III, outline your involvement in preparing and filing the tax returns. Answer each question regarding your knowledge of income and tax obligations during that period.

- In Part IV, summarize your current financial situation, including assets and income. Complete the tables provided for clarity.

- If applicable, complete Part V, providing details related to any domestic violence or abuse experienced, which may affect your eligibility for relief.

- In Part VI, add any additional information that might influence the IRS's decision regarding your request.

- Indicate if you wish to receive a refund in Part VII by checking the box, and then sign and date the form. Review all entries for accuracy before submission.

- Finally, save your changes and choose to download, print, or share the completed form as necessary.

Get started on filing your Form 8857 online today.

Where should I file my Innocent Spouse claim? You may fax the Form 8857 and attachments to the IRS at 855-233-8558. Note: Please do not file the Form 8857 with your tax return or Tax Court.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.