Loading

Get Estimated Vouchers Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Estimated Vouchers Form online

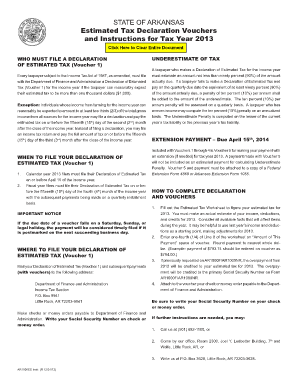

This guide provides a comprehensive overview of how to accurately complete the Estimated Vouchers Form for the state of Arkansas online. Whether you are new to tax forms or seeking clarity on specific sections, this guide will support you through the process.

Follow the steps to complete your Estimated Vouchers Form seamlessly.

- Click the ‘Get Form’ button to access the Estimated Vouchers Form and open it in your preferred online editor.

- Carefully enter your primary name and, if applicable, your partner's name in the designated fields. Ensure both names are spelled correctly to avoid any issues.

- Fill in your and your partner's Social Security Numbers in the provided sections. This information is crucial for processing your form appropriately.

- Indicate the due date for each installment and ensure it matches the appropriate deadlines based on whether you are filing for the calendar year or fiscal year.

- Utilize the Estimated Tax Worksheet to compute your estimated tax for the year. Enter the adjusted gross income, deductions, and tax credits as required and make necessary calculations.

- In the 'Amount of this Payment' section, enter one-fourth of the estimated tax amount, rounded to the nearest whole dollar.

- Review the completed form for accuracy, ensuring all fields are correctly filled out, including your address and contact information.

- Once all sections are correctly filled, save your changes, and you can download, print, or share the Estimated Vouchers Form as needed.

Complete your Estimated Vouchers Form online today for a smooth tax filing experience!

Related links form

You may also make estimated tax payments if the withholding from your salary, pension or other income doesn't cover your income tax for the year. You make your estimated payments based on the income you expect to earn and any credits you expect to receive in the year.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.