Loading

Get How To Fill Out Berkheimer Tax Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the How To Fill Out Berkheimer Tax Form online

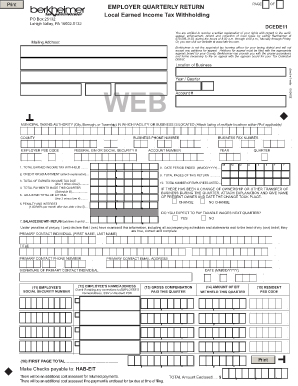

Completing the Berkheimer Tax Form online can seem daunting, but with organized steps, it can be accomplished efficiently. This guide will provide you with a clear and structured approach to help you navigate through the form successfully.

Follow the steps to fill out the form accurately.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the year and quarter for which you are filing in the designated fields. This information is critical for accurate reporting.

- Fill in your account number and business details, including the employer PSD code, business phone, and federal EIN or Social Security number, in the appropriate sections.

- Provide the total earned income tax withheld from all employees' wages for the quarter. Ensure this amount reflects the summary of earnings for the entire time period.

- If applicable, state any credits or adjustments in the designated area. Include an explanation for each adjustment.

- Calculate the total of earned income tax due by subtracting any credits or adjustments from the total withheld.

- Enter the total payments that have been made during the quarter as part of Schedule B.

- Compute the adjusted total of earned income tax due by subtracting the total payments from the total tax due.

- If applicable, calculate any penalty and interest owed based on the adjusted total of tax due.

- Add the adjusted total tax due and any penalties calculated to determine the balance due with the return.

- Complete the remaining fields noting the number of employees and any changes in ownership, if applicable.

- Enter your contact information, sign the form, and include the date.

- Once all sections are completed and reviewed, save your changes, download a copy for your records, and print or share the form as needed.

Complete your Berkheimer Tax Form online today to ensure accurate and timely filing.

Related links form

You can file manually by completing Form 1040 ing to instructions provided by the IRS. This would require you to either e-file or physically mail the form to the IRS, along with any payment you owe. You can use a tax software program or the website of a service such as TurboTax or H&R Block.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.