Loading

Get Form 1256 Gains And Losses Pdf 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Form 1256 Gains And Losses Pdf 2013 online

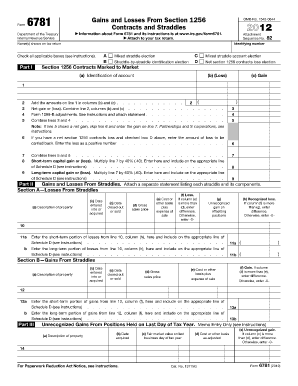

Filling out the Form 1256 Gains And Losses is essential for accurately reporting gains and losses related to section 1256 contracts. This guide provides straightforward steps on how to complete this form online, ensuring you can easily navigate each section.

Follow the steps to successfully complete Form 1256 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your identifying number and the name(s) shown on your tax return in the designated fields at the top of the form.

- Check any applicable boxes related to elections you are making regarding mixed straddle treatment in Part I.

- Fill in the details regarding your section 1256 contracts, including identification, loss, and gain for each contract held as of the tax year end.

- Sum the amounts of gains and losses in columns as instructed, and record the net gain or loss on the appropriate lines.

- If applicable, provide any adjustments from Form 1099-B in Part II by including a separate statement if necessary.

- Complete the sections for straddle gains and losses, ensuring you accurately describe, enter dates, sales prices, and costs for each straddle involved.

- Review your completed entries for accuracy before moving to the final lines where you input any carried back losses and report on Schedule D.

- Once all sections are filled out, check to ensure all changes are saved, and utilize options to download, print, or share your completed form as needed.

Complete your forms online today to simplify your tax reporting process.

A Section 1256 contract specifies an investment made in a derivatives instrument whereby if the contract is held at year-end, it is treated as sold at fair market value at year-end. The implied profit or loss from the fictitious sale is treated as short- or long-term capital gains or losses.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.