Loading

Get Mo 941 X 2010 Underpayment Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Mo 941 X 2010 Underpayment Form online

Filling out the Mo 941 X 2010 Underpayment Form online is a straightforward process designed to assist employers in correcting their withholding tax reports. This guide provides clear, step-by-step instructions to ensure that your form is completed accurately and efficiently.

Follow the steps to complete the Mo 941 X 2010 Underpayment Form online

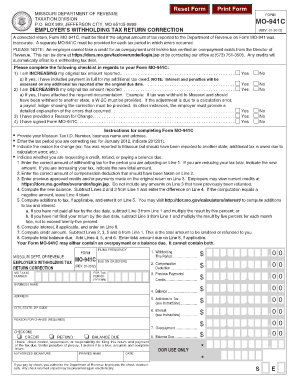

- Click the ‘Get Form’ button to access the Mo 941 X 2010 Underpayment Form and open it in your preferred editing platform.

- Begin by providing your Missouri Tax Identification Number, along with your business name and address in the designated fields.

- Indicate the tax period you are correcting, formatted as follows: YYYYMM (for example, for January 2012, you would enter 201201).

- Clearly state the reason for the change you are reporting. Provide specific details such as whether the tax was incorrectly reported or if adjustments are due to errors.

- Select your request type by indicating whether you are seeking a credit, refund, or if you are paying a balance due.

- Fill in Line 1 with the accurate amount of withholding tax for the period you are adjusting, stating clearly whether the amount is an increase or decrease.

- Complete Line 2 by entering the correct amount of compensation deductions that should have been claimed.

- List any previous payments or approved credits made on Line 3. Ensure not to include amounts that have already been refunded.

- Calculate the new balance for Line 4 by subtracting Lines 2 and 3 from Line 1. Keep Line 4 blank if the calculation results in a negative number.

- If applicable, compute any additions to tax and enter the result on Line 5, referring to the provided instructions for this calculation.

- Complete Line 6 with any calculated interest, if applicable.

- For Line 7, compute the credit amount by subtracting Lines 2, 3, 5, and 6 from Line 1.

- Finish by calculating the total balance due on Line 8, which should include Lines 4, 5, and 6. Enter the total if applicable.

- Review all entries for accuracy, then save your changes, and choose the option to download, print, or share the completed form as needed.

Start filling out your Mo 941 X 2010 Underpayment Form online for seamless tax correction!

If you need a copy of a past Form 941 that you have filed, you can request a copy through the Internal Revenue System. Each copy costs $57.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.