Loading

Get Berkheimer W 2r

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Berkheimer W 2r online

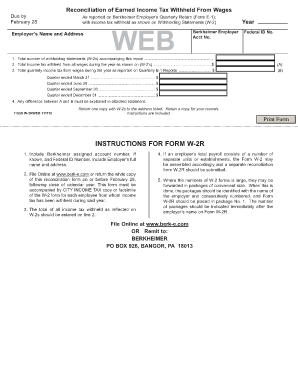

Filling out the Berkheimer W 2r form is an essential task for employers reconciling earned income tax withheld from wages. This guide provides clear and structured steps to help you complete the form smoothly and accurately.

Follow the steps to complete your Berkheimer W 2r form online.

- Press the ‘Get Form’ button to access the Berkheimer W 2r form, allowing you to open and complete it in the designated online environment.

- Enter your Berkheimer assigned account number and Federal ID number in the appropriate fields, along with the employer’s full name and address. This information is essential for proper identification and processing.

- Indicate the year for which you are filing the reconciliation as well as the total number of W-2 withholding statements that you are submitting with this report. Make sure this number aligns with the actual documents you are attaching.

- On line 2, enter the total income tax withheld from all wages during the year as reported on your W-2s. This ensures that the total tax withheld is accurately documented.

- Complete lines that detail total quarterly income tax from wages. Provide this information for each quarter, ensuring accuracy for correct reporting: March 31, June 30, September 30, and December 31.

- If there is any difference between the total amount of income tax withheld and what is reported on your quarterly returns, be sure to include a detailed explanation in an attached statement.

- Once all fields have been filled out accurately, save your changes. You can then choose to download, print, or share the completed Berkheimer W 2r form as necessary.

Ensure your tax reporting is accurate by completing your Berkheimer W 2r form online today.

Berkheimer Associates - This company handles local taxes of over 1,100 Pennsylvania municipalities and school districts. Many forms are not accessible through this page; in many cases one must contact Berkheimer directly.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.