Loading

Get Omb # 1545 0008 2010 W 2 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Omb # 1545 0008 2010 W 2 Form online

Filling out the Omb # 1545 0008 2010 W 2 Form online is a straightforward process that enables employers to report wages, tips, and taxes withheld for their employees. This guide provides step-by-step instructions to ensure accurate and efficient completion of the form.

Follow the steps to complete the Omb # 1545 0008 2010 W 2 Form online.

- Click the ‘Get Form’ button to access the form digitally and open it for editing.

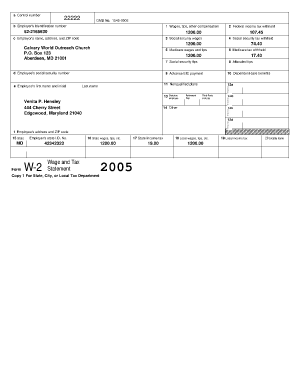

- Begin by entering the employer's identification number in the designated box labeled 'b Employer’s Identification number'. Ensure accuracy as this number is crucial for tax reporting.

- Fill in the 'c Employer's name, address, and ZIP code'. Include the full name of the employer, along with their mailing address.

- Move to section '1 Wages, tips, other compensation' to record the total wages and tips the employee received. Ensure the amount reflects accurate compensation for the tax year.

- In section '2 Federal income tax withheld', enter the amount of federal income tax that has been withheld from the employee's pay. This number should correspond with payroll records.

- Enter the 'd Employee's social security number' in the appropriate field to identify the employee for social security purposes.

- Fill in 'e Employee's first name and initial' and 'Last name'. Ensure that both names are spelled correctly.

- Complete the employee's address in the 'f Employee's address and ZIP code' field, ensuring it is current and accurate.

- For state-specific information, fill out '15 State' and 'Employer's state I.D. No.', including state wages, and tax withheld in the relevant fields.

- Once all fields are accurately filled, review the form for errors or omissions before finalizing.

- After completing the form, users can save changes, download, print, or share the completed Omb # 1545 0008 2010 W 2 Form.

Complete your documents online today for a seamless filing experience.

To order official IRS information returns such as Forms W-2 and W-3, which include a scannable Copy A for filing, go to IRS' Online Ordering for Information Returns and Employer Returns page, or visit www.irs.gov/orderforms and click on Employer and Information returns.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.