Loading

Get 2012 Instruction 1099-general - Internal Revenue Service

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the 2012 Instruction 1099-GENERAL - Internal Revenue Service online

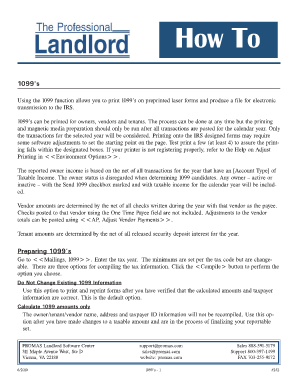

Navigating the process of filling out the 2012 Instruction 1099-GENERAL can be complex, especially for users with limited experience in digital document management. This guide provides clear, step-by-step instructions to assist you in completing the form accurately and effectively online.

Follow the steps to fill out the form correctly.

- Click ‘Get Form’ button to obtain the form and open it in the editor. This will allow you to access the required fields for completion.

- Enter the tax year in the designated field. Note that the minimum thresholds are predetermined by tax regulations but are adjustable if necessary.

- Select the compilation option suitable for your needs. You may choose from: 'Do Not Change Existing 1099 Information', 'Calculate 1099 amounts only', or 'Calculate all 1099 information'. Click the <Compile> button to execute your selection.

- Once the 1099 preview screen displays, review the list of potential recipients. Utilize the tabs at the bottom to view specific categories, such as those who are below the minimum income thresholds or those marked as non-reportable due to errors.

- When ready to print or create electronic files, confirm all necessary corrections have been made. Click the <Print Laser 1099's> button or the <Create Electronic Filing Output File> button to proceed.

- Finalize your documents by saving changes, downloading, or printing the completed forms as needed. Ensure to follow IRS guidelines for any electronic submissions.

Start completing your 2012 Instruction 1099-GENERAL online today to ensure timely and accurate filing.

Issuing Forms 1099 to Clients That means law firms often cut checks to clients for a share of settlement proceeds. Even so, there is rarely a Form 1099 obligation for such payments. Most lawyers receiving a joint settlement check to resolve a client lawsuit are not considered payors.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.