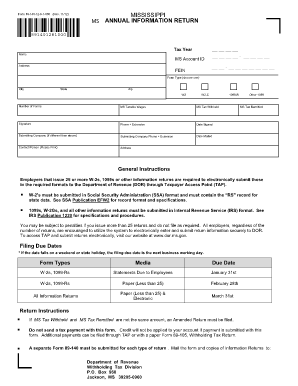

Get Form 89 140 12 8 1 000

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign Form 89 140 12 8 1 000 online

How to fill out and sign Form 89 140 12 8 1 000 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Feel all the advantages of completing and submitting legal forms on the internet. Using our service filling out Form 89 140 12 8 1 000 usually takes a few minutes. We make that possible by offering you access to our full-fledged editor effective at altering/correcting a document?s original text, adding special boxes, and putting your signature on.

Complete Form 89 140 12 8 1 000 within several moments by using the recommendations below:

- Select the document template you will need from our collection of legal forms.

- Choose the Get form key to open the document and begin editing.

- Fill in all of the requested fields (these are yellowish).

- The Signature Wizard will help you put your e-signature as soon as you have finished imputing data.

- Put the relevant date.

- Look through the whole document to make sure you?ve filled in all the data and no changes are needed.

- Click Done and save the filled out template to your gadget.

Send your new Form 89 140 12 8 1 000 in an electronic form when you finish filling it out. Your information is well-protected, as we adhere to the most up-to-date security requirements. Join millions of happy customers that are already submitting legal forms right from their apartments.

How to edit Form 89 140 12 8 1 000: customize forms online

Choose a rock-solid document editing option you can trust. Revise, execute, and certify Form 89 140 12 8 1 000 securely online.

Very often, editing documents, like Form 89 140 12 8 1 000, can be pain, especially if you received them in a digital format but don’t have access to specialized software. Of course, you can find some workarounds to get around it, but you can end up getting a form that won't meet the submission requirements. Using a printer and scanner isn’t an option either because it's time- and resource-consuming.

We provide a simpler and more efficient way of completing forms. An extensive catalog of document templates that are easy to edit and certify, to make fillable for others. Our platform extends way beyond a collection of templates. One of the best parts of using our services is that you can revise Form 89 140 12 8 1 000 directly on our website.

Since it's an online-based platform, it saves you from having to download any computer software. Plus, not all company rules permit you to install it on your corporate laptop. Here's how you can easily and securely execute your paperwork with our solution.

- Hit the Get Form > you’ll be immediately redirected to our editor.

- Once opened, you can start the customization process.

- Choose checkmark or circle, line, arrow and cross and other choices to annotate your document.

- Pick the date option to add a specific date to your document.

- Add text boxes, images and notes and more to complement the content.

- Use the fillable fields option on the right to create fillable {fields.

- Choose Sign from the top toolbar to generate and create your legally-binding signature.

- Hit DONE and save, print, and share or download the end {file.

Forget about paper and other ineffective ways of completing your Form 89 140 12 8 1 000 or other forms. Use our solution instead that combines one of the richest libraries of ready-to-customize templates and a powerful document editing services. It's easy and safe, and can save you lots of time! Don’t take our word for it, try it out yourself!

Mississippi's 2023 withholding formula was released by the state revenue department and is the first to use a flat tax rate. Legislation passed in 2022 (H.B. 531) introduced a flat 5% tax rate on annual income over $10,000 starting in 2023.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.