Loading

Get Example Of Schedule E

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Example Of Schedule E online

This guide provides detailed steps for successfully completing the Example Of Schedule E online. Whether you're new to tax filing or need a refresher, this comprehensive overview will help you navigate the form with ease.

Follow the steps to complete your Example Of Schedule E online

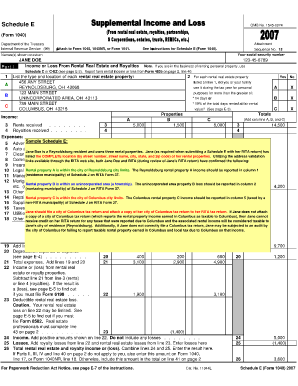

- Press the ‘Get Form’ button to access the Example Of Schedule E. Open the form in your preferred online editing tool.

- Begin by entering your social security number in the designated field. This is crucial for identification purposes.

- Under 'Names(s) shown on return,' list your name or the names of individuals filing the return.

- In Part I, provide detailed information about each rental real estate property. For each property, you must include the type and full address.

- Indicate whether you or your family used any of the rental properties for personal purposes during the tax year. Check 'Yes' or 'No' as appropriate.

- Report rents received for each property in the corresponding fields. Ensure you include the total rents received from all properties.

- For royalties received, enter the amounts in the appropriate fields. Combine these with rents on the total income line.

- Deduct relevant expenses for each rental property including advertising, cleaning and maintenance, and others. Summarize these in the expense section.

- Calculate the total of all expenses and subtract this from the total rents or royalties to determine your income or loss from rental activities.

- Review all entries for accuracy and completeness. Ensure all required fields are filled to avoid processing delays.

- Save your changes, then download or print the completed form for your records. Follow instructions for submission as needed.

Complete and submit your Example Of Schedule E online to ensure accurate tax reporting.

Schedule E is used to report "passive" income. This income is either rental income you receive because you own rental property, or a royalty payment you receive. ... SCH C is used to report self-employment business income. This is income that you go out and actually "do" something to earn it.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.