Loading

Get Sc1040tc

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Sc1040tc online

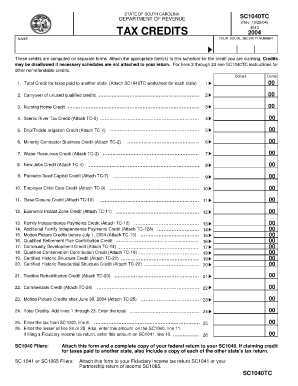

This guide provides a comprehensive overview of how to fill out the Sc1040tc form online. The Sc1040tc is essential for claiming various tax credits in South Carolina, and this step-by-step approach will help users accurately complete the form.

Follow the steps to successfully complete the Sc1040tc form.

- Click ‘Get Form’ button to obtain the form and open it in the editing interface.

- Begin by entering your social security number and name as required at the top of the form. Ensure that this information matches your tax records.

- Proceed to lines 1-24, where you will enter the specific tax credits you are claiming. Make sure to attach the appropriate supporting forms for each credit.

- For lines 1-23, detail each applicable credit, ensuring that you provide amounts in the correct format (Dollars and Cents). Check the instructions for each credit type for accurate information.

- At line 25, enter the tax amount from your SC1040, line 8. This will help calculate the total credits.

- On line 26, record the lesser amount of line 24 or line 25, and if applicable, enter it on SC1041, line 10 if you are filing a fiduciary income tax return.

- After completing the form, carefully review all entries for accuracy. Double-check that all necessary forms are attached based on the credits claimed.

- Finally, save your changes, then download, print, or share the completed form as needed.

Complete your Sc1040tc form online today to ensure you get the credits you deserve!

Related links form

South Carolina (Married couples who filed jointly will receive only one rebate.) Those who did not pay income taxes -- around 44% of South Carolinians -- did not receive a check. If you filed your 2021 income tax return by Oct. 17, you should have received your rebate by the end of 2022.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.