Loading

Get 433 F Tax Relif Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 433 F tax relief form online

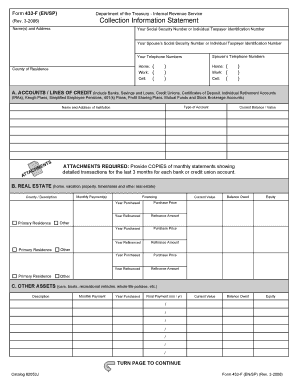

Completing the 433 F Tax Relief Form online is an essential process for users seeking to establish a suitable payment plan for owed tax amounts. This guide provides a thorough walkthrough of each section of the form, ensuring you can effectively fill it out and submit it without any confusion.

Follow the steps to complete the form accurately.

- Press the ‘Get Form’ button to obtain the form and open it in your preferred online editor.

- In Section A, list all accounts and lines of credit, even if they currently have no balance. Exclude any bank loans from this section.

- For Section B, enter all real estate owned or being purchased. Include your primary residence and any others, along with details such as the county, purchase year, current market value, and amount owed.

- In Section C, itemize all other assets like cars, boats, and recreational vehicles. Indicate if any vehicles are leased by writing 'lease' in the appropriate field.

- Complete Section D by listing all credit cards and lines of credit, ensuring to include any balances, even if they are currently at zero.

- For Section E, provide wage information by listing your employer's name and address, as well as your spouse's. Include income details for both parties and check the payment frequency.

- In Section F, enter monthly amounts for non-wage household income from various sources. Calculate amounts for income not received monthly using the specified division or multiplication methods.

- Proceed to Section G and record your monthly necessary living expenses. Ensure to clarify any non-monthly expenses using the provided calculations.

- Finally, review your entries for accuracy. Once you have completed all sections, save any changes, and consider downloading, printing, or sharing the form as needed.

Start filling out your 433 F Tax Relief Form online today to ensure a smooth submission process.

Related links form

Form 433-F is used to obtain current financial information necessary for determining how a wage earner or self-employed individual can satisfy an outstanding tax liability. Note: You may be able to establish an Online Payment Agreement on the IRS web site.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.