Loading

Get South Carolina W4 Form 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the South Carolina W4 Form 2019 online

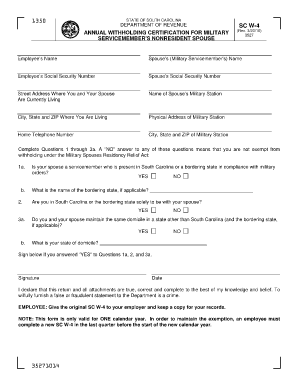

Filling out the South Carolina W4 Form 2019 is essential for military servicemembers' nonresident spouses to claim exemption from state withholding tax. This guide will walk you through the necessary steps to complete the form effectively online, ensuring that you understand each section and its requirements.

Follow the steps to complete the South Carolina W4 Form 2019 online.

- Click ‘Get Form’ button to access and open the South Carolina W4 Form 2019 in your web browser.

- Begin by entering your name in the designated field labeled 'Employee’s Name.' Following that, input your spouse’s name under 'Spouse’s (Military Servicemember’s) Name.'

- Fill in both you and your spouse's Social Security Numbers in the corresponding fields.

- Provide your current street address where you and your spouse reside, as well as the physical address of your spouse’s military station.

- Indicate your home telephone number and the city, state, and ZIP code for both your residence and the military station.

- Answer questions 1 through 3a carefully; a 'NO' response to any question indicates you are not exempt from withholding under the Military Spouses Residency Relief Act.

- If applicable, fill out the name of the bordering state for question 1b. Ensure to complete the final question by naming your state of domicile.

- If you answered 'YES' to questions 1a, 2, and 3a, sign and date the form to affirm that the information provided is accurate to the best of your knowledge.

- Once completed, you can save your changes, or download and print the form for your records.

- Finally, submit the original SC W-4 to your employer and retain a copy for personal records.

Complete your documents online today to ensure your tax exemption is processed correctly.

Step 1: Enter Personal Information. This step must be completed by all employees. ... Step 2: Multiple Jobs or Spouse Works. ... Step 3: Claim Dependents. ... Step 4: Other Adjustments. ... Step 5: Make sure your employee has signed the form.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.