Loading

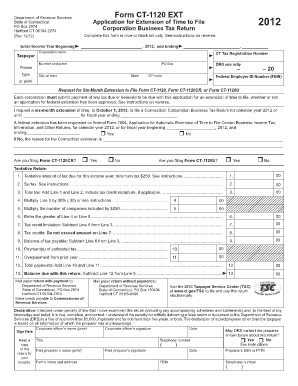

Get 2012 Ct Corporate Extension Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2012 Ct Corporate Extension Form online

Filing the 2012 Ct Corporate Extension Form is essential for corporations seeking to request an extension for submitting their Corporation Business Tax Return. This guide will provide clear and structured steps to help users fill out the form online efficiently.

Follow the steps to successfully complete the extension form online.

- Click ‘Get Form’ button to access the 2012 Ct Corporate Extension Form. This action will allow you to open the form in your browser or preferred editor.

- Begin by entering the income year information. Specify the beginning and ending dates for the income year for your corporation.

- In the 'Taxpayer' section, type or print the name of the corporation along with the CT Tax Registration Number. Also, provide the address details, including the number and street, city or town, state, and ZIP code.

- Enter the Federal Employer ID Number (FEIN). This is a crucial identifier for your corporation.

- Indicate if you are requesting a six-month extension by checking the appropriate box. If a federal extension was requested, indicate 'Yes' or 'No' accordingly.

- If you answered 'No' to the federal extension question, provide a reason for the Connecticut extension request in the designated space.

- Respond to the questions regarding whether you are filing Form CT-1120CR or Form CT-1120U by appropriately selecting 'Yes' or 'No' for each.

- Calculate the tentative amount of tax due and enter it under the 'Tentative Return' section. Keep in mind the minimum tax of $250.

- Complete the calculations for any applicable surtax and total tax due, following the line instructions provided in the form.

- Finalize your form by reviewing all the entered information to ensure its accuracy. Sign the form where indicated, and provide the corporate officer's name and title.

- Once all fields are completed, save changes to the form. You can then choose to download, print, or share the form as needed.

Complete your 2012 Ct Corporate Extension Form online today for a smooth filing process.

You may obtain an extension of time to file your North Dakota corporation, s-corporation, partnership, or fiduciary income tax return by obtaining either a federal extension or a North Dakota extension.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.