Loading

Get 1 Es Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1 Es Form online

This guide will assist you in filling out the 1 Es Form online with ease and confidence. By following these step-by-step instructions, you will ensure that your form is completed accurately and efficiently.

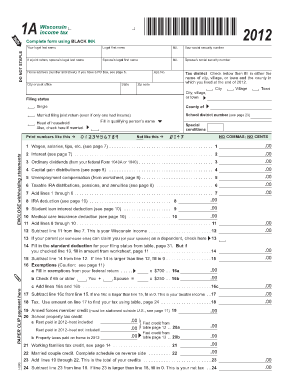

Follow the steps to complete the 1 Es Form online

- Click 'Get Form' button to access the form and open it in your online editor.

- Begin by entering your legal last name, first name, and middle initial in the respective fields. Ensure accuracy to avoid processing delays.

- Input your social security number in the designated section. If you are filing jointly, also provide your spouse’s details in the corresponding fields.

- Fill in your home address, including the street number, city, state, and zip code. If you prefer to use a PO Box, refer to the instructions indicated on page 6.

- Select your filing status by checking the appropriate box. Options include single, married filing jointly, and head of household. If applicable, fill in the name of the qualifying person.

- Proceed to enter your income sources in the respective fields. This includes wages, salaries, interest, dividends, and other incomes as listed on the form.

- Calculate your total income by adding the amounts from the relevant lines and inputting the result in the specified field.

- Complete the deductions section by entering any applicable deductions such as IRA contributions or student loan interest. Ensure that all numbers are entered without commas and cents.

- Review your taxable income calculation to confirm its accuracy. If there are exemptions, deduct them accordingly and fill in the final taxable amount.

- Fill out any tax credits you may qualify for, following the instructions for additional forms to attach, if necessary.

- Before finalizing, double-check all entries for accuracy. Once confirmed, utilize the options to save changes, download, print, or share your completed form.

Complete your 1 Es Form online today for a streamlined filing experience.

Use Form 1040-ES to figure and pay your estimated tax. Estimated tax is the method used to pay tax on income that is not subject to withholding (for example, earnings from self-employment, interest, dividends, rents,alimony, etc.).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.