Loading

Get Form R 10615

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form R 10615 online

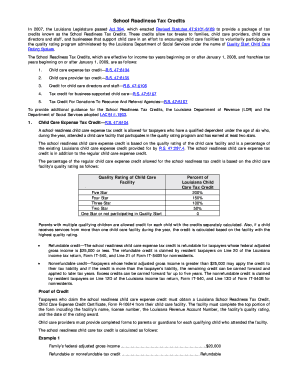

This guide provides clear and supportive instructions to help users complete the Form R 10615 online. The form pertains to the School Readiness Tax Credit for child care directors and staff, ensuring that users can navigate the process with ease.

Follow the steps to fill out the Form R 10615 online.

- To begin, press the ‘Get Form’ button to access the online form. This will allow you to fill it out digitally.

- Review the form's requirements and ensure that you possess the necessary certification from your child care provider, which verifies your eligibility for the tax credit.

- Fill in your personal information in the designated fields. Ensure all details are accurate and match your official documents.

- Provide your child care facility's information as requested, including the facility's name, license number, and quality rating, which must be obtained from the certification.

- Indicate the amount of time you have worked at the facility by entering the start and end dates in the appropriate fields.

- Submit any additional required documentation or certifications as specified in the form, ensuring they are readily accessible.

- Once you have completed all sections of the form, review it carefully for any errors or omissions.

- Finally, you can save the changes, download, print, or share the completed form as required.

Complete your Form R 10615 online today to take full advantage of the School Readiness Tax Credits.

The tax credit is claimed on the Resident Individual Income Tax return, Form IT-540, Schedule F, or the Nonresident and Part-Year Resident Individual Income Tax Return, Form IT-540B, Schedule F-NR. LDE will provide certification to child care directors and staff indicating the educational level achieved by January 31.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.