Loading

Get Form Oq

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form Oq online

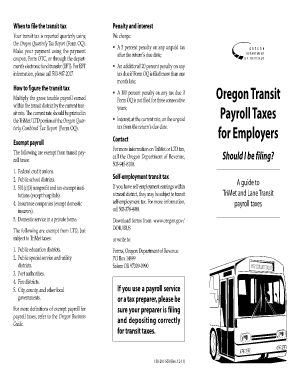

Filling out the Form Oq online is an essential step for employers who are required to report transit taxes in Oregon. This guide provides a clear, step-by-step process to assist you in completing the form accurately and efficiently.

Follow the steps to complete the Form Oq online effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Provide your business information in the designated fields. Ensure that you enter your legal business name, address, and tax identification number correctly.

- Calculate the gross taxable payroll for the period being reported. This should include all earnings that are subject to transit tax within the transit district.

- Enter the calculated gross taxable payroll amount in the appropriate field. Ensure that you reference the current transit tax rate to make accurate calculations.

- Review any exemptions that might apply to your business as outlined in the form. If applicable, document these exemptions in the specified section of the form.

- Double-check all entered data for accuracy. It is essential to ensure that all calculations align with the current tax requirements before submission.

- Once all sections are complete and verified, save your changes. You may also download or print the form for your records.

- Finally, submit the completed Form Oq online as instructed within the form guide to ensure timely processing.

Start completing your Form Oq online today to stay compliant with transit tax regulations.

Related links form

Form OQ, Oregon Quarterly Combined Tax Report is used to determine how much tax is due each quarter for state unemployment and withholding; the Workers' Benefit Fund; and TriMet and Lane Transit excise taxes.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.