Loading

Get Editable California K 1 541 2011 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

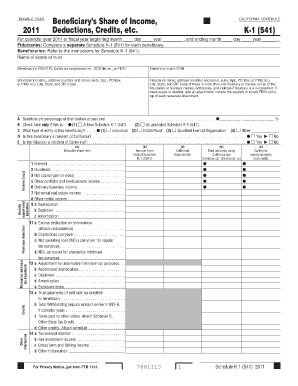

How to fill out the Editable California K 1 541 2011 Form online

Filling out the Editable California K 1 541 2011 Form online can be a straightforward process with the right guidance. This comprehensive guide will walk you through each section of the form, ensuring accuracy and compliance as you navigate the requirements.

Follow the steps to complete the form accurately.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the taxable year at the top of the form, which is pre-filled as 2011. Make sure this is correct for your filing.

- Fill in the name of the estate or trust and corresponding identification numbers, such as the beneficiary's SSN, ITIN, or FEIN, in the designated fields.

- Complete the beneficiary's name, address, city, state, and ZIP Code accurately to ensure proper identification.

- Report the fiduciary's information including name and address. If there are multiple fiduciaries, list them all and note if any are non-residents.

- Indicate the beneficiary’s percentage of distribution at year-end. This is crucial for determining the share of income or credits allocated to the beneficiary.

- Check the applicable boxes if this is a final or amended Schedule K-1.

- Specify the type of entity of the beneficiary by marking the appropriate box (individual, estate/trust, qualified exempt organization, or other).

- Answer the residency questions regarding the beneficiary and the fiduciary, marking yes or no accordingly.

- Fill out the allocable share items, entering amounts from the federal Schedule K-1 (1041) and making any necessary California adjustments.

- For lines detailing income, deductions, and credits, input figures based on the estate’s or trust’s performance for the taxable year.

- Review attached schedules for items such as passive activities, adjustments, or other specific tax considerations.

- After completing the form, ensure to save changes. Options may include downloading, printing, or sharing the filled document as required.

Start completing your documents online now to ensure timely and accurate submissions.

For Estates With No Income If the estate or trust has no income or a gross income of less than $600 within the tax year, then there is no need to file a return. However, if one of the beneficiaries is a nonresident alien, then a trust or estate must file a tax return (even if it does not have any income).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.