Loading

Get 2012 Ca Form 592 Re File

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2012 Ca Form 592 Re File online

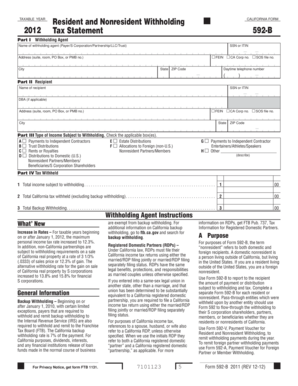

This guide provides comprehensive, step-by-step instructions for filling out the 2012 California Form 592 Re File online. Whether you are a withholding agent or a recipient, this user-friendly resource will help you navigate the form’s sections effectively.

Follow the steps to complete your form successfully.

- Click 'Get Form' button to obtain the form and open it for editing.

- In Part I, enter the name of the withholding agent. Provide the tax identification number (SSN or ITIN, FEIN, CA Corp number, or SOS file number) along with the agent's address, city, state, and ZIP code. Don’t forget the daytime telephone number.

- In Part II, input the recipient's name, tax identification number, and address. If applicable, include the DBA and ensure the information is accurate.

- In Part III, check the applicable boxes to indicate the type of income subject to withholding. Ensure that you select all relevant options.

- In Part IV, line 1, enter the total income subject to withholding. On line 2, indicate the total California tax withheld, excluding backup withholding. Finally, on line 3, record any backup withholding applicable.

- Review all entries for accuracy. Make sure all required fields are completed.

- Once all fields are properly filled, save your changes. You can then download, print, or share the completed form as needed.

Complete your filing of the 2012 Ca Form 592 Re File online today for accurate and timely tax reporting.

Backup withholding is a type of income tax withheld on specific income types when a payee fails to: Provide the payer a correct taxpayer identification number (TIN) Certify exemption from backup withholding.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.