Loading

Get Tsc Form 472

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tsc Form 472 online

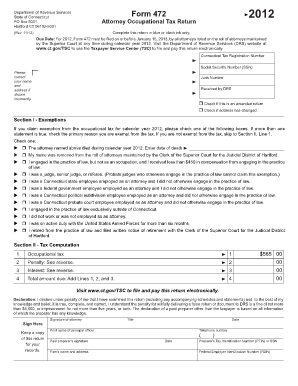

Filling out the Tsc Form 472 online is a straightforward process that allows attorneys to file their occupational tax return efficiently. This guide will provide you with the necessary steps to complete the form accurately and submit it on time.

Follow the steps to fill out the Tsc Form 472 online.

- Click 'Get Form' button to access and launch the form in the editor.

- Enter your Connecticut Tax Registration Number at the designated field. If you do not have one, skip this step.

- Fill in your Juris Number. Ensure it is accurate; cross off incorrect information and write the correct number next to it.

- Review the declaration statement and ensure that your return is true and complete. Sign and date the form where indicated.

- Save any changes made to the form, and proceed to download, print, or share your Form 472 as necessary.

Complete your Forms online today for a hassle-free submission.

LLCs taxed as C-Corp When filing as a C-Corp, your LLC will need to pay the 21% federal corporate income tax rate along with the 7.5% Connecticut corporate tax rate. Consult a CPA before changing your LLC's tax status to ensure that filing as a C-Corp will truly benefit your LLC.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.