Loading

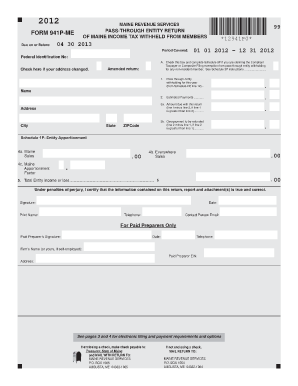

Get 941p Me 2012 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 941p Me 2012 Form online

Filling out the 941p Me 2012 Form online can streamline your reporting process for pass-through entity income tax withheld from members. This guide offers clear, step-by-step instructions to assist you in completing the form accurately.

Follow the steps to successfully complete the 941p Me 2012 Form online.

- Press the ‘Get Form’ button to access the 941p Me 2012 Form, which you can then view and edit in your preferred editor.

- Begin by entering your Federal Identification Number in the designated field. Ensure it is accurate to avoid processing delays.

- Indicate the period covered by the form, which should reflect the year 2012, from January 1, 2012, to December 31, 2012.

- If your address has changed, check the box provided and complete Schedule 3P for any necessary exemptions regarding non-resident members.

- Complete the pass-through entity withholding amount for the year, taken from Schedule 2P, line 12. Ensure that calculations are consistent.

- Fill in the amount due with this return, calculated as the difference between line 1 and line 2 if applicable, reflecting any amounts owed.

- If applicable, indicate any overpayment that is to be refunded in section 3b. This reflects the amount if the overpayment exceeds the pass-through entity withholding.

- Proceed to fill out Schedule 1P to provide details on entity apportionment, including Maine sales and apportionment factors.

- In the Schedule 2P section, list each member involved, including their name, Social Security Number or EIN, distributive share percentage, and the Maine income tax withheld.

- Once all sections are filled out, review the information for accuracy, and prepare to submit it according to the filing instructions outlined.

- After confirming that all information is correct, save your changes, and either download, print, or share the completed form as needed.

Start filling out the 941p Me 2012 Form online now for an efficient tax filing experience.

Partnership and S-Corporation - Maine allows an automatic six-month extension of time to file if a federal extension has been granted. If any pass-through entity withholding is due, however, that amount must be paid by March 15.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.