Loading

Get What Is Form 5806

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the What Is Form 5806 online

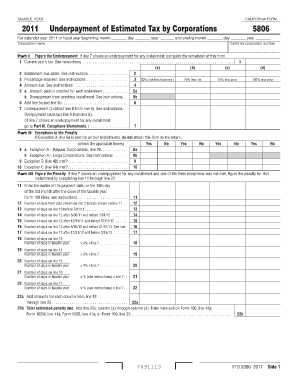

Form 5806 is essential for corporations to report underpayments of estimated tax and calculate any potential penalties. This guide provides clear, step-by-step instructions for completing the form online, ensuring that all necessary information is accurately captured.

Follow the steps to complete Form 5806 online effectively.

- Press the ‘Get Form’ button to access the form and open it in your editor.

- Enter the corporation name and California corporation number at the top of the form.

- If line 7 indicates an underpayment, you must complete the rest of the form.

- In Part I, specify the current year's tax by entering the amount from the relevant tax form.

- Fill in the installment due dates in the provided columns according to the fiscal calendar.

- Indicate the percentage required for your company, typically as outlined in the instructions.

- Calculate the amounts due for each installment in the subsequent lines, ensuring the totals are accurate.

- Proceed to Part II to check for any exceptions to the penalty, marking applicable boxes.

- In Part III, only if there’s an underpayment, complete the penalty calculation by following the provided formulas.

- Wrap up the form by reviewing all entries for accuracy, then save changes, download, print, or share the completed form as needed.

Complete your Form 5806 online today to ensure compliance and avoid potential penalties.

Penalty. 25% of the total tax amount due, regardless of any payments or credits made on time.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.