Loading

Get W2g, 1099 Or Win/loss Statement Request

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the W2G, 1099 Or Win/Loss Statement Request online

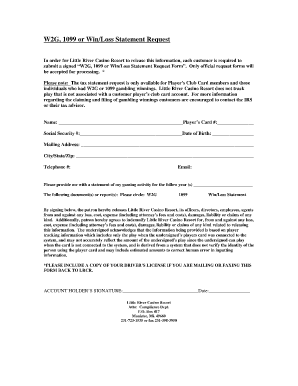

If you need to request a statement of your gaming activity from Little River Casino Resort, filling out the W2G, 1099 or Win/Loss Statement Request form online is a streamlined process. This guide will provide clear, step-by-step instructions to ensure you complete the form accurately and effectively.

Follow the steps to fill out the W2G, 1099 or Win/Loss Statement Request form online

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In the first section, provide your name, as recorded on your Player’s Club Card.

- Enter your Player’s Card number, ensuring it is accurate for proper identification.

- Fill in your Social Security number and date of birth. Ensure that all information is accurate and matches official documents.

- Complete your mailing address, including street address, city, state, and zip code.

- Provide your telephone number and email address for any communication regarding your request.

- Indicate the year or years for which you are requesting the gaming activity statement.

- In the document selection area, circle the relevant document(s) you are requesting: W2G, 1099, or Win/Loss Statement.

- Sign the form to acknowledge the release of information and the terms stated, including the necessary indemnification clause.

- Include a copy of your driver’s license if you are planning to mail or fax the form back to Little River Casino Resort.

- Once all fields are completed, save any changes you made. You can then download, print, or share the form as needed.

Complete your W2G, 1099 or Win/Loss Statement Request form online to manage your gaming activity records efficiently.

If you need a duplicate W-2G form, you may obtain one by visiting the Department of Revenue's Personal Income Tax e-service center. Please select the option for Personal Income Tax Account Access. You will be required to create a user id and password.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.