Loading

Get Ct W4na 2013 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CT W4NA 2013 form online

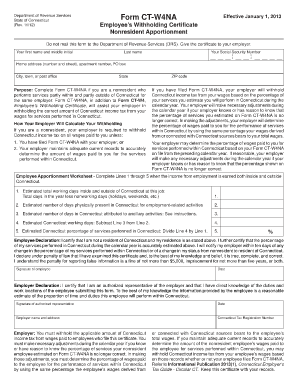

The CT W4NA 2013 form is essential for nonresidents working in Connecticut to ensure accurate tax withholding. This guide provides a comprehensive, step-by-step approach to filling out the form online effectively.

Follow the steps to complete the CT W4NA 2013 form easily.

- Click 'Get Form' button to obtain the form and open it in your preferred editor.

- Enter your Social Security number in the designated field. This is required for identification purposes.

- Fill in your last name, first name, and middle initial as requested in the appropriate fields.

- Provide your home address, including the number and street, apartment number (if applicable), and PO box. Next, enter your city, town, or post office along with the state.

- Complete the employee apportionment worksheet by following the instructions given. Start with the estimated total working days inside and outside of Connecticut.

- Estimate the number of days you will be physically present in Connecticut for work-related activities and fill in the respective field.

- Estimate the number of days spent in Connecticut on ancillary activities and enter this information.

- Calculate and fill in your estimated Connecticut working days by subtracting the ancillary days from the number of days physically present.

- Determine the estimated percentage of services performed in Connecticut and fill this out in the designated field.

- Complete the employee declaration by certifying your residency status and the accuracy of your service percentage.

- Sign and date the form where indicated. Make sure your signature is clear.

- Once all sections are completed, you can save your changes, download, print, or share the form with your employer.

Complete your documents online today to ensure compliance and accuracy in your tax withholdings.

You are a nonresident for the 2022 taxable year if you are neither a resident nor a part-year resident for the 2022 taxable year. If you are a nonresident and you meet the requirements for Who Must File Form CT‑1040NR/PY for the 2022 taxable year, you must file Form CT‑1040NR/PY.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.