Loading

Get Worksheet For Calculating Your 2012 Rmd - Dreyfus

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Worksheet For Calculating Your 2012 RMD - Dreyfus online

This guide provides a clear and comprehensive approach to filling out the Worksheet for Calculating Your 2012 RMD - Dreyfus online. Users of all experience levels can follow these straightforward steps to ensure accurate calculations for required minimum distributions.

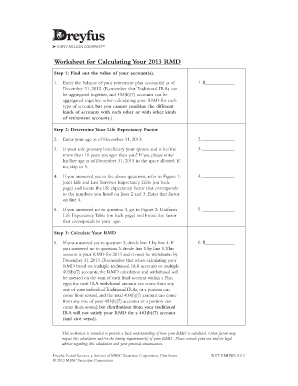

Follow the steps to complete your RMD worksheet accurately.

- Click ‘Get Form’ button to access the worksheet. This action will allow you to open the form for completion.

- Find out the value of your account(s). Enter the balance of your retirement plan account(s) as of December 31, 2012. Note that Traditional IRAs and 403(b)(7) accounts can be aggregated, but not combined with different account types.

- Determine your life expectancy factor by entering your age as of December 31, 2013.

- If your sole primary beneficiary is your spouse and is more than 10 years younger than you, enter their age as of December 31, 2013. If not, proceed to step 5.

- If you answered yes to the previous question, refer to Figure 1: Joint Life and Last Survivor Expectancy Table to find your life expectancy factor based on your age and your spouse's age. Enter that factor here.

- If you answered no to the spouse question, find the appropriate factor from Figure 2: Uniform Life Expectancy Table based on your age and enter it here.

- Calculate your RMD by dividing the amount from step 1 by the factor you found in either step 4 or step 6, depending on your previous answers. This is the amount you must withdraw by December 31, 2013.

- Once you have completed all entries, you can save your changes, download, print, or share the completed form as needed.

Start completing your Worksheet for Calculating Your 2012 RMD - Dreyfus online today.

But RMDs will return in 2021. Since retirees will be a year older than when they last took their RMDs, they'll have to take out a slightly higher percentage from their retirement plans. There's one little-known way to reduce RMD shock in 2021 and beyond.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.