Loading

Get Rp 459

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Rp 459 online

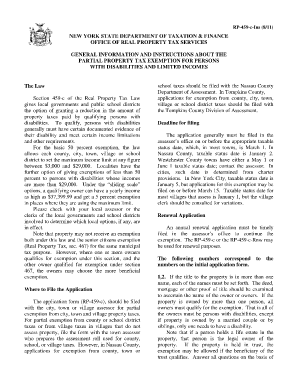

Filling out the Rp 459 form is a vital step for individuals with disabilities seeking property tax exemption. This guide will walk you through the process of completing the form online, ensuring you have all the necessary information to submit a successful application.

Follow the steps to complete the Rp 459 form online.

- Click the ‘Get Form’ button to obtain the Rp 459 application form and open it in your preferred editor.

- Begin by providing the title information for the property. If the property is owned by multiple people, ensure all names are included as they appear on the deed.

- Fill in the property location as per the latest assessment roll. If you have questions about the property description, contact your local assessor.

- Describe the physical or mental impairment that qualifies you for exemption. Ensure that it does not arise from current illegal drug use or alcohol.

- Select and check the appropriate boxes that indicate which documentation certifying your disability you are including with your application.

- Provide proof of ownership by attaching a copy of the relevant deed or mortgage document. This proof typically does not need to be submitted annually unless requested by the assessor.

- Confirm that the property serves as your legal residence and note if any portion is used for non-residential purposes. Indicate if you reside in a facility for health-related services.

- Detail your total income from the previous tax year, including all sources and ensuring you adhere to the income limits set by local government.

- If applicable, claim any medical expenses that are not reimbursed, ensuring to check with your assessor to see if this deduction is available in your area.

- Attach copies of federal and New York State income tax returns for the previous year, as these will help substantiate your income claims.

- Review the form for accuracy and completeness before saving your changes.

- Once satisfied, choose to download, print, or share the completed form according to your needs.

Take the next step in your application process by filing the Rp 459 online today.

To be eligible for a homeowner tax rebate credit in 2022, you must have: qualified for a 2022 STAR credit or exemption, had income that was less than or equal to $250,000 for the 2020 income tax year, and. a school tax liability for the 2022-2023 school year that is more than your 2022 STAR benefit.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.