Loading

Get Rp 458 A

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Rp 458 A online

Filling out the Rp 458 A form is essential for obtaining the alternative veterans exemption from real property taxation. This guide provides a step-by-step approach to ensure that all sections of the form are completed accurately and efficiently.

Follow the steps to complete the Rp 458 A form online.

- Click the ‘Get Form’ button to obtain the form and open it in the online editor.

- Begin by providing your name and contact information in the designated fields. If the property is owned by more than one person, include all names and relevant contact details.

- Input the address of the property, ensuring it matches the description on the latest assessment roll. You may need to contact your local assessor for confirmation.

- Indicate your eligibility by selecting the appropriate boxes that describe your status as a veteran or qualifying family member, including any relevant military service periods.

- Attach any required documentation that verifies your military service, such as Form DD 214 or evidence of honorable discharge.

- If applicable, provide proof of any additional exemptions, such as service-connected disability ratings or combat zone service documentation.

- Confirm that the property is used exclusively for residential purposes. If part of it is used commercially, specify the percentage that is residential.

- Ensure you attach a copy of the deed showing title ownership and any other documents that support your application.

- Review all entered information for accuracy and completeness.

- Save your changes, then download, print, or share the completed form as required. Ensure to submit it to the local assessor before the specified taxable status date.

Complete your Rp 458 A application online today to secure your veterans exemption!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

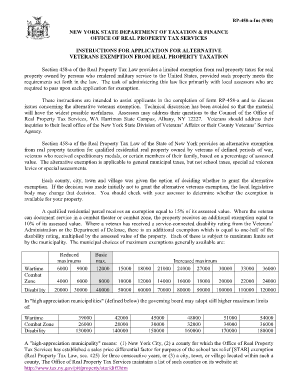

In general, a qualifying wartime veteran's property receives an exemption of 15% of its assessed value. An additional 10% exemption is available where the veteran can document service in a combat theatre or zone.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.