Loading

Get Idaho Form 850

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Idaho Form 850 online

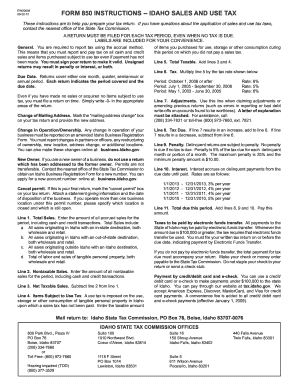

Filling out the Idaho Form 850 is essential for reporting sales and use tax. This guide provides clear, step-by-step instructions to help you complete the form online, ensuring that you understand each section and its requirements.

Follow the steps to fill out the Idaho Form 850 online effectively.

- Click ‘Get Form’ button to access the Idaho Form 850 and open it in your preferred editor.

- Review the general instructions carefully. Ensure you understand the accrual method of reporting, meaning you must report and pay tax on all cash and credit sales, even if payment has not been made.

- Complete the necessary sections, starting with your total sales. Enter the total amount of all accrued sales for the period on Line 1, which includes sales originating in Idaho or outside with an Idaho destination.

- On Line 2, report any nontaxable sales made during the period, ensuring you include both cash and credit transactions.

- Calculate your net taxable sales by subtracting the amount on Line 2 from Line 1. Enter this figure on Line 3.

- If you purchased items subject to use tax during the reporting period, indicate this amount on Line 4.

- Add the amounts from Lines 3 and 4 to find your total taxable amount. Enter this sum on Line 5.

- Calculate the tax due by multiplying the figure on Line 5 by the appropriate tax rate indicated for your reporting period and write it on Line 6.

- If you need to claim adjustments, complete Line 7, providing an explanation if necessary.

- Determine the tax due on Line 8 by considering any adjustments. Ensure your total is accurate.

- If applicable, calculate any penalties for delinquent returns on Line 9 and interest on Line 10. Add these to find the total due for this period to be written on Line 11.

- After completing all lines, review your form for accuracy, save the changes, and proceed to download, print, or share the completed form as needed.

Complete your Idaho Form 850 online today for accurate tax reporting and compliance.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Oregonians purchasing goods or services online don't generally owe sales tax to another state, but exceptions may exist for other taxes. For example, when making online travel arrangements, you will be charged federal taxes on airline tickets and may be charged state and local taxes on your hotel or rental car.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.