Loading

Get Par 101

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Par 101 online

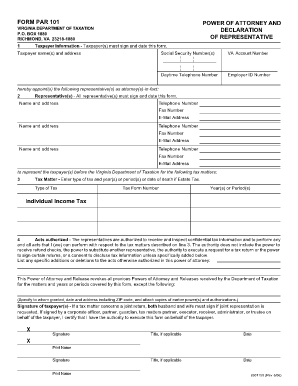

The Par 101 form, also known as the Power of Attorney and Declaration of Representative, is a crucial document for taxpayers wishing to designate a representative for tax matters. This guide provides step-by-step instructions for filling out the form online, ensuring that you can complete it accurately and efficiently.

Follow the steps to complete the Par 101 online.

- Press the ‘Get Form’ button to access the Par 101 form and open it in your browser or preferred editor.

- In the taxpayer information section, input the name(s) and address of the taxpayer(s). Ensure you include the required Social Security Number(s), Virginia Account Number, daytime telephone number, and Employer ID Number.

- In the representative(s) section, provide the name(s) and address of the person(s) authorized to act on behalf of the taxpayer(s). Each representative must also provide their telephone number, fax number, and email address.

- Specify the type of tax and the year(s) or period(s) relevant to the tax matters. If applicable, include the date of death for Estate Tax matters, and indicate the corresponding tax form number.

- In the acts authorized section, clearly outline any specific powers granted to the representatives. Note that certain powers, such as receiving refund checks or substituting another representative, are not included unless explicitly stated.

- If there are previous Powers of Attorney that you wish to revoke, list them in the designated section, specifying to whom they were granted, the date, and the relevant address.

- Finally, ensure that all required signatures are obtained from the taxpayer(s). If applicable, include title information for corporate officers or other representatives signing on behalf of the taxpayer. Do not forget to date the signatures.

- After completing the form, save your changes. You may also download, print, or share the completed Par 101 form as needed.

Complete your document online today and ensure your tax matters are properly managed.

To have a refund issued to anyone other than a surviving spouse or court-appointed or certified personal representative, file IRS Statement of Person Claiming Refund Due a Deceased Taxpayer (Form 1310) when filing the federal return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.