Loading

Get 1099 Contractor Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1099 Contractor Form online

Filling out the 1099 Contractor Form online can seem daunting, but with step-by-step guidance, you can navigate the process with ease. This guide will help you understand each component of the form and how to complete it accurately.

Follow the steps to successfully complete the 1099 Contractor Form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

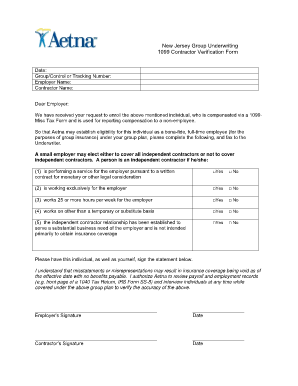

- Enter the date at the top of the form. Ensure that the date reflects when you are filling out the form to maintain accurate records.

- In the Group/Control or Tracking Number field, input the identifying number associated with your employer's group insurance plan.

- Enter the employer's name in the designated field. This should be the official name of the business or organization that is contracting the services.

- In the Contractor Name section, write the full name of the individual who is working as an independent contractor.

- Respond to the eligibility questions regarding the independent contractor by checking 'Yes' or 'No' as applicable. Make sure to review each statement carefully before answering.

- After answering the eligibility questions, the employer needs to sign the statement provided at the end of the form, affirming the accuracy of the information submitted.

- The contractor must also sign the specified area to confirm the information and acknowledgment of terms.

- Finally, once all sections are complete, you can save your changes, download the form for your records, print it for submission, or share it as needed.

Complete your documents online today to ensure accurate and efficient processing.

The difference between 1099 vs W-9 is a straightforward one: the contractor fills out the W-9 form to provide information to the business they work for, and that business later reports the contractor's yearly earnings on the 1099 form.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.