Loading

Get Ohio Fillable Tax Return Forms

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ohio Fillable Tax Return Forms online

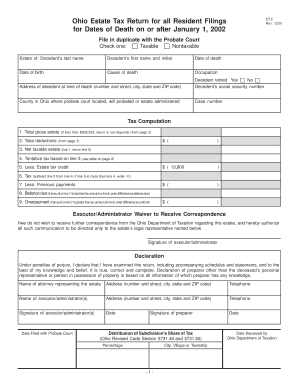

Filling out the Ohio estate tax return forms requires careful attention to detail to ensure compliance with state regulations. This guide will walk you through the steps needed to complete the Ohio Fillable Tax Return Forms online, providing clarity and support along the way.

Follow the steps to effectively complete your estate tax return.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Complete the initial information section including the name, date of death, and address of the decedent. This provides essential details for identification.

- Fill out the ‘Tax Computation’ section by entering the total gross estate and total deductions. Ensure that the net taxable estate is accurately calculated by subtracting deductions from the gross estate.

- Refer to the tax table provided to determine the tentative tax based on the net taxable estate. Input this amount into the designated field.

- Deduct any applicable estate tax credit from the tentative tax to determine the tax owed. If the credits exceed the tentative tax, enter zero.

- Record any previous payments made towards the estate tax to further clarify the balance owed or any potential overpayment indicating a refund.

- Complete the executor/administrator waiver if you prefer to receive correspondence only through your legal representative.

- In the declaration section, certify the accuracy of the information provided by signing and dating where required.

- After confirming the information is correct in all sections of the form, save your changes, download the completed form, print it for your records, or share it as needed.

Complete your Ohio estate tax return forms online today for a smooth filing experience.

n Attach a copy of Forms W-2, W-2G and 2439 to the front of Form 1040. Also attach Forms 1099-R if tax was withheld. n Use the coded envelope included with your tax package to mail your return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.