Loading

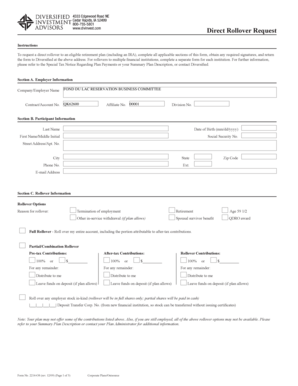

Get Diversified Investment Advisors Direct Rollover Request Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Diversified Investment Advisors Direct Rollover Request Form online

This guide provides comprehensive instructions on completing the Diversified Investment Advisors Direct Rollover Request Form online. By following these steps, users can easily navigate through the form to request a direct rollover to an eligible retirement plan.

Follow the steps to complete your rollover request.

- Press the ‘Get Form’ button to access the Diversified Investment Advisors Direct Rollover Request Form. This will allow you to open the form in an editable format.

- Begin by filling out Section A with your employer information. Enter the company name, contract/account number, and any additional required identifiers.

- Proceed to Section B to provide your personal information. Fill in your last name, date of birth, first name, social security number, address, city, state, phone number, zip code, and email address.

- In Section C, specify the rollover options. Indicate the reason for the rollover and select between a full or partial rollover. If applicable, fill in the amounts for pre-tax and after-tax contributions.

- Continue to specify the type of rollover in Section C. Choose where you want to roll over the funds, such as to a Traditional IRA or a Roth IRA, and provide the relevant provider information.

- Complete the payment options section by choosing between check or wire transfer. If selecting wire transfer, enter the necessary details such as ABA number and institution name.

- If you have any outstanding loans, address this in Section D by selecting your desired option regarding loan repayments or rollovers.

- In Section E, make any necessary selections regarding tax withholding elections that apply to your rollover options.

- Sign the form in Section F to confirm the information provided is accurate. If married and applicable, obtain spousal consent in Section G.

- Finally, submit the completed form to Diversified Investment Advisors. You can save your changes, download the document, print, or share it as needed.

Complete the Diversified Investment Advisors Direct Rollover Request Form online today to ensure a smooth rollover process.

Decide where you want the money to go. Choose a brokerage or bank that you want to roll over your money to. ... Decide what kind of account you want. ... Contact the right institution to open your account. ... See what the procedure is to begin the rollover process. ... Remember the 60-day rule.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.