Loading

Get South Dakota Importer And Exporter Tax Return Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the South Dakota Importer And Exporter Tax Return Form online

Filling out the South Dakota Importer And Exporter Tax Return Form online can seem daunting, but with the right guidance, you can complete it efficiently. This guide will walk you through each section of the form, ensuring you have the information you need to file successfully.

Follow the steps to complete the form accurately.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

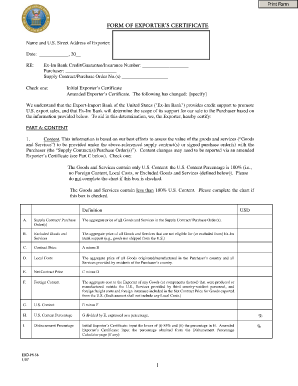

- Begin by entering the name and U.S. street address of the exporter at the top of the form. This information is critical for establishing your identity as the exporter.

- Fill in the date of the transaction in the designated area.

- Provide the Ex-Im Bank credit, guarantee, or insurance number if applicable.

- Identify the purchaser by filling in their name, and include the supply contract or purchase order number.

- Choose whether this is an initial or amended exporter’s certificate by checking the appropriate box and specifying any changes if necessary.

- In Part A, input the details about the value of goods and services. Complete the chart as needed, depending on whether the goods and services contain only U.S. content or less than 100%.

- In Part B, review and certify the required statements accurately, ensuring you meet all conditions set forth regarding payment, invoices, legal compliance, and other related certifications.

- If amendments are required, refer to Part C and fill out the amended exporter’s certificate as necessary.

- Once all information is complete and verified, save your changes. You may then download, print, or share the completed form based on your needs.

Complete your South Dakota Importer And Exporter Tax Return Form online today to ensure timely and accurate filing.

Denver's current sales tax rate is 3.65% for non-food items and 4% for food and beverages sold at retail. 4% for prepared food and beverages.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.