Loading

Get Crummy Letter

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Crummy Letter online

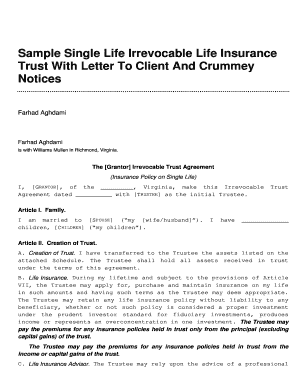

Filling out the Crummy Letter correctly is essential for proper trust management and compliance. This guide provides step-by-step instructions to assist users in completing the form accurately and efficiently online.

Follow the steps to complete the Crummy Letter with ease.

- Click ‘Get Form’ button to obtain the Crummy Letter and open it in the editor.

- Begin by entering your personal information in the designated fields. Provide your name as the Grantor and the date of the agreement.

- In the sections related to family, specify your marital status and list the names of your children. This ensures clarity in the trust's beneficiaries.

- Complete Article II by describing the creation of the trust. Indicate the assets that have been transferred to the Trustee and ensure all necessary details are accurate.

- Outline the life insurance arrangements. Specify if the Trustee has the authority to manage and maintain insurance policies as indicated in the document.

- Address the terms of withdrawal rights for any partner by filling in the appropriate sections about the withdrawal limits and guidelines.

- Review all entries for accuracy. Make any necessary corrections to ensure that all information reflects your intentions clearly.

- Once all sections are completed and you are satisfied with your entries, you can save your changes, download the completed form, print it, or share it as needed.

Complete your Crummy Letter online today for effective trust management.

A "5 by 5 Power in Trust" is a common clause in many trusts that allows the trust's beneficiary to make certain withdrawals. Also also called a "5 by 5 Clause," it gives the beneficiary the ability to withdraw the greater of: $5,000 or. 5% of the trust's fair market value (FMV) from the trust each year.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.