Loading

Get उपवत

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the उपवत online

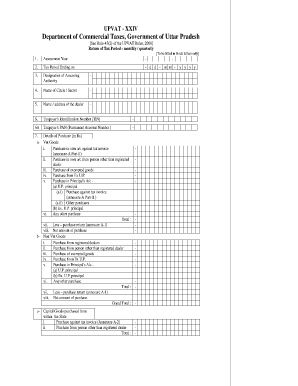

The उपवत form is essential for filing your tax returns related to value-added tax in Uttar Pradesh. This guide provides clear, step-by-step instructions on how to accurately complete the form online, ensuring compliance with all necessary regulations.

Follow the steps to fill out the उपवत form with ease.

- Press the ‘Get Form’ button to access the उपवत form and open it for completion.

- Begin by filling in the assessment year, using block letters as required.

- Indicate the tax period ending date in the specified format.

- Provide the designation of the assessing authority.

- Enter the name and address of the dealer.

- Fill in the taxpayer's identification number (TIN) and permanent account number (PAN).

- Complete the details regarding purchases categorized under VAT and non-VAT goods, ensuring you report each purchase accurately according to the specified sections.

- Document total amounts, purchases, and any returns in the appropriate fields.

- Fill out the sales details in the designated sections, noting any sales returns.

- Compute tax on purchases and sales by entering the correct tax computations.

- Complete the sections for tax payable, TDS, and ITC, providing clarity on any adjustments.

- Review the form for accuracy, save changes, and proceed to download, print, or share the completed document.

Start completing your उपवत form online today to ensure timely and accurate tax submissions.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.