Loading

Get Irs Form 8880 For 2017

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Form 8880 for 2017 online

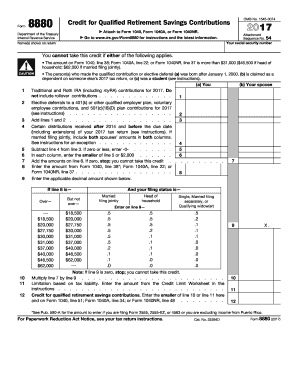

Filling out IRS Form 8880 is essential for individuals looking to claim retirement savings contributions credits. This guide offers clear, step-by-step instructions for completing the form online, making the process simple and efficient.

Follow the steps to accurately fill out your IRS Form 8880 online.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- Provide your social security number and name(s) as shown on your tax return in the appropriate fields at the top of the form.

- In Part I, enter the contributions made to your traditional and Roth IRAs that are not rollover contributions in line 1. Continue to line 2 for elective deferrals to a 401(k) or other qualified employer plans.

- Add the amounts from lines 1 and 2. Enter the sum in line 3.

- If you received certain distributions after 2014, as specified in the form's instructions, enter that total in line 4.

- Subtract line 4 from line 3 and enter the result on line 5. If the result is zero or less, enter -0-.

- On line 6, enter the smaller of line 5 or $2,000.

- Add the amounts from line 6 across any applicable columns and check if the total is zero. If zero, you cannot take this credit.

- Enter your income amount from the relevant line of Form 1040, Form 1040A, or Form 1040NR in line 8.

- Refer to the table provided in the form for line 9 and enter the applicable decimal based on your adjusted gross income.

- Multiply the amount from line 7 by the applicable decimal amount on line 9 and enter the result on line 10.

- Next, complete the limitations based on tax liability in line 11. Refer to the Credit Limit Worksheet for calculations.

- Enter the smaller amount from line 10 or line 11 in line 12 as your credit for qualified retirement savings contributions.

- Once completed, save your changes, and download or print the form for your records. You may also share the form if needed.

Complete your IRS Form 8880 online to claim your retirement savings credit efficiently.

In order to qualify, you'll need to have made contributions to an IRA, Roth IRA, or 401(k) or other similar elective contribution programs. You'll also need to make less than certain limits on gross adjusted income, depending on filing status.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.