Loading

Get Transfer Tax Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Transfer Tax Form online

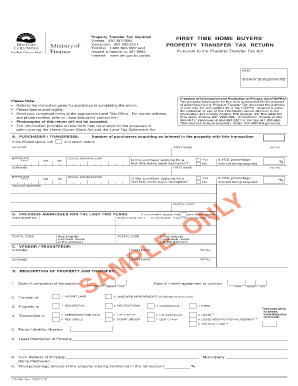

Filling out the Transfer Tax Form online can streamline your property transfer process. This guide provides clear and supportive instructions for each section of the form, ensuring users understand how to complete it effectively.

Follow the steps to fill out your Transfer Tax Form online

- Press the ‘Get Form’ button to access the Transfer Tax Form and open it for editing.

- Begin by filling out section A (Purchaser/Transferee). Enter the surname, first name, birthdate, and social insurance number for all purchasers. Indicate if they are applying for a first-time home buyer exemption.

- Complete section B (Previous Addresses for the Last Two Years). Provide past addresses of the purchasers. If you need more space, tick the appropriate box and attach additional information.

- In section C (Vendor/Transferor), input the surname and first name of the vendor, filling in all necessary details.

- Fill out section D (Description of Property and Transfer), including the completion date, parcel identifier number, legal description, and civic address. Make sure to indicate the percentage interest in the property being transferred.

- Section E (Terms) requires entering financial details such as cash payments, financing amounts, and total gross purchase price. Ensure amounts are accurate and reflect current transaction values.

- In section F (Property Transfer Tax Calculation), enter the fair market value and calculate the associated tax based on provided instructions.

- Complete section G (Additional Information) by answering questions about property size and residency status, as applicable.

- If the property is larger than 0.5 hectares or contains non-residential improvements, complete section H (Proportional Calculation) for accurate tax assessment.

- Finally, sign and date the certification portion at the end of the form. Confirm that all entered information is complete and correct.

- Once completed, save changes to the form and consider downloading or printing it for your records. You can also share the form as needed.

Start filling out your Transfer Tax Form online today to ensure a smooth property transaction.

The Mansion tax is a 1% levy, payable by the buyer at closing, that is charged on every property, regardless of size, that sells in New York for a purchase price of 1 million dollars or more.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.