Loading

Get Fnma Form 1084

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Fnma Form 1084 online

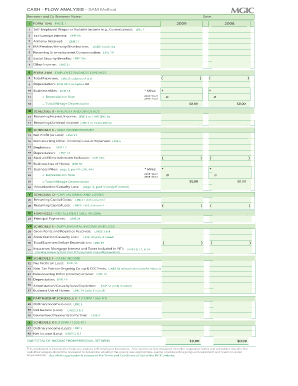

Filling out the Fnma Form 1084 online can be a straightforward process when you have a clear guide. This form is essential for analyzing the cash flow of borrowers, particularly those who are self-employed. Below, you will find a detailed step-by-step guide to assist you in completing the form accurately.

Follow the steps to successfully complete the Fnma Form 1084 online.

- Press the ‘Get Form’ button to obtain the Fnma Form 1084 and open it in your document editor.

- Begin by entering the borrower and co-borrower names at the top of the form. Ensure that you spell their names correctly and provide any required identification information.

- Fill in the date of the evaluation, ensuring that you select the correct year. This is important for accurate recordkeeping.

- Proceed to the income sections of the form. In each relevant line, enter the appropriate figures regarding tax-exempt interest, alimony received, pensions, and any other income sources as indicated.

- Review the business expenses section, ensuring that all business miles, depreciation, and total expenses are accurately recorded. Use the specified lines for each component.

- If applicable, include details for partnerships, S Corporations, and Regular Corporations. Make sure to multiply by the ownership percentage where indicated.

- Before finalizing, conduct a thorough review of all entries for accuracy. Make any necessary adjustments.

- Once completed, save your changes and select the options to download, print, or share the form as needed.

Start filling out the Fnma Form 1084 online today to streamline your document management.

Line 22 — Amortization/Casualty Loss: Amortization expenses are usually one-time costs that are distributed over a period of time and can therefore be added to Total Income. Casualty losses are typically nonrecurring, add them to Total Income. Consider if losses are on NONCASH lines.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.