Loading

Get K 40c

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the K 40c online

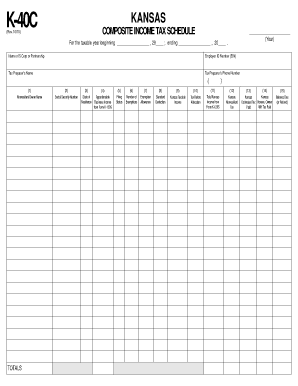

The K 40c form is used for filing composite income tax returns for nonresident partners or shareholders in Kansas. This guide will provide clear instructions on how to navigate and complete the form online, ensuring your submission is accurate and compliant.

Follow the steps to fill out the K 40c online effectively.

- Click ‘Get Form’ button to download the K 40c form and open it in your preferred editing tool.

- Enter the taxable year at the top of the form. Indicate the start and end dates using the format: month/day/year.

- Fill in the name of the S corporation or partnership as it appears in official documents.

- Provide the Employer Identification Number (EIN) for the entity.

- Enter the name of the tax preparer along with their phone number for reference.

- List the names of each nonresident owner in Column 1.

- Input the Social Security number for each nonresident owner in Column 2.

- In Column 3, specify the state of residence for each nonresident owner.

- Enter the apportionable business income for each nonresident owner from Form K-120S in Column 4.

- Select the appropriate filing status from Column 5 based on each owner's federal filing information.

- Count and record the number of exemptions for each shareholder or partner in Column 6, including any additional exemptions as applicable.

- Calculate the exemption allowance in Column 7 by multiplying the number of exemptions by $2,250.

- Determine the standard deduction and enter the appropriate amount in Column 8 for each owner, following the Kansas standard deduction guidelines.

- Calculate the Kansas taxable income for each nonresident owner in Column 9 by subtracting the total of columns 7 and 8 from column 4.

- Apply the Kansas tax computation schedule to determine the tax before allocation in Column 10.

- In Column 11, record each nonresident's share of total Kansas income from Form K-120S.

- Calculate the Kansas nonresident tax in Column 12, based on the allocation percentage.

- Input the amount of any Kansas estimated tax paid in Column 13.

- Record the nonresident withholding tax in Column 14.

- Determine the balance due or refund in Column 15 by adding columns 13 and 14, then subtracting column 12.

- Finally, review all entries for accuracy, save any changes, and prepare to submit the form as required by enclosing it with the Form K-40.

Complete your K 40c online today to ensure timely filing!

There are three tax brackets in the Sunflower State, with your state income tax rate depending on your income level. Income tax rates in Kansas are 3.10%, 5.25% and 5.70%.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.